WeChat Crossborder Payment (WePay) is not particularly new, but to a lot of businesses outside China it can still seem like magic.

The concept is simple: customers pay with their regular WeChat account in RMB, and the money directly arrives in your oversea account in the local currency. As of today (October 11th) , it supports 8 foreign currencies: USD, Euro, Australian dollar, Singapore dollar, Korean won, Japanese yen, British Pound and Hong Kong dollar.

How does it work? How to apply for it? What are the exact terms of use? We are taking you through all of these questions.

How to apply:

The application can be handled from WeChat crossborder payment website

Go to the following url:

http://global.tenpay.com/self_application/apply.shtml

When applying, select “WeChat Official Account Payment checkbox”

What are the fees?

Account creation fee: free

Transaction fee: 3%

Settlement date: T +1 (T means transaction date)

Minimal settlement amount: 5000 USD

Bank fee: shared (Tenpay covers bank fee for transferring money out from the Chinese bank; other charges such as cost of intermediary banks or receiving banks are covered by account owner)

What are the requirements?

Any foreign company can apply.

But there is a catch: you will need to have a China visible WeChat Official Account (OA). Two ways you can apply for this type of account:

- For most companies, you need to find a local company who has Chinese business license to apply for a Chinese OA.

- For foreign companies who is exporting a physical product to China, you can create a Chinese OA with your foreign business license.

You will also need a local company (with a Chinese business license) to enter the agreement and take part of the legal risk (contact info@walkthechat.com for further information about this process)

Application process lasts for about two months (as of today)

Why is it useful?

The usefulness of WeChat crossborder payment accounts can hardly be overstated. They will mostly benefit two industries.

Tourism

the WeChat crossborder payment application enables Chinese users to purchase items directly from shops, hotels or restaurants abroad without having to exchange currency or withdraw money: a key factor which will increase the amount of purchases among Chinese tourists.

Export

WeChat crossborder will also enable companies outside China to sell in the Chinese market without having to set-up shop in China.

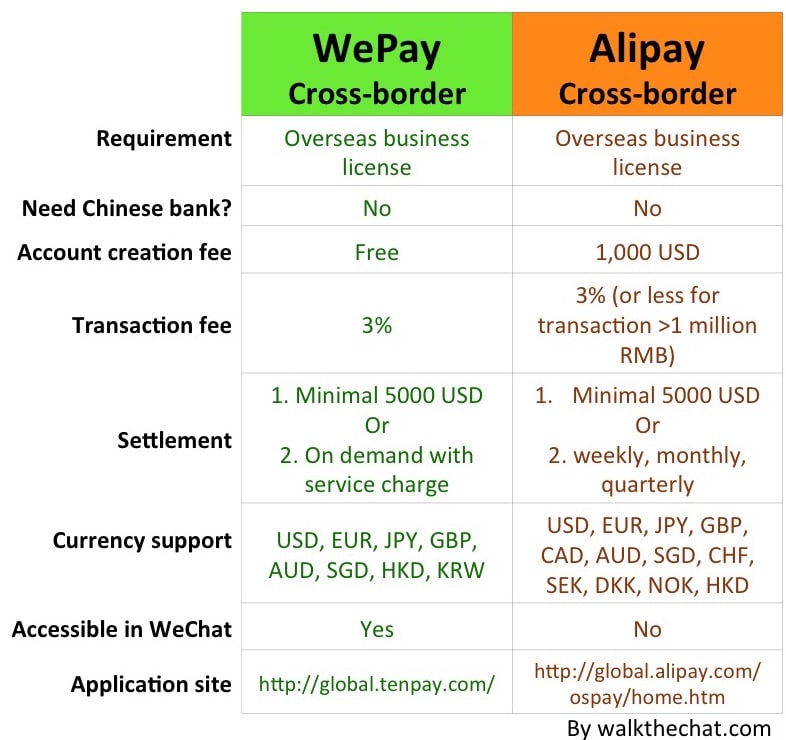

How does WePay crossborder compares with Alipay Cross-border?

Alipay cross-border is an alternative payment solution. It has been around for longer and it is more widely used today. The drawback is that Alipay is not accessible through WeChat and there is a 1000USD setup fee (this policy may evolve over time).

Here is a graph showing the side by side comparison of WeChat Crossborder and Alipay Crossborder.

Conclusion

Compared to Alipay Crossborder and Tmall Global, the WeChat Cross-border option has lower barrier to entry and is directly accessible via WeChat. Smaller brands can use WeChat Crossborder Payment with social promotion and Key Opinion Leaders to test the market without the huge expense associated with Tmall Crossborder.