Quest Mobile Female Consumption Trend Report

Quest Mobile released the Female Consumption Trend Report.

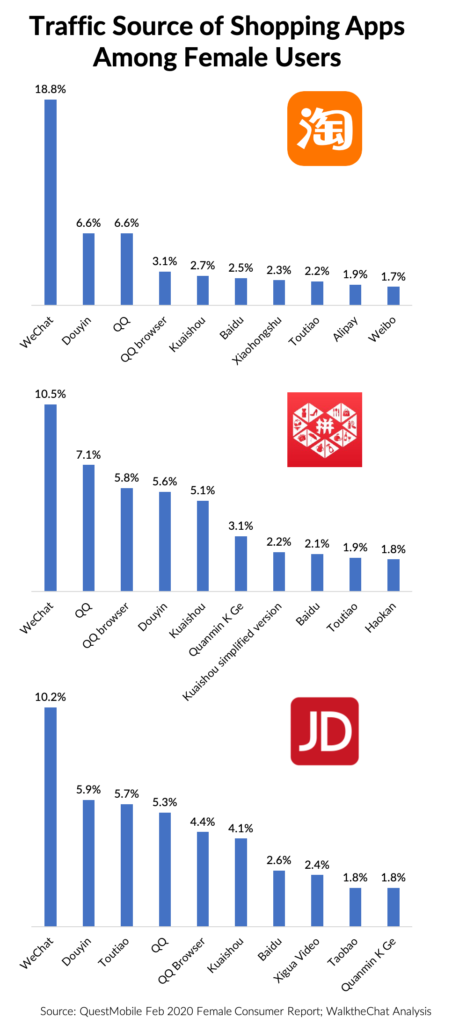

WeChat is the top traffic source for Taobao (excluding direct traffic) among female consumers: 18.8% of Taobao female consumer traffic initiates from WeChat. In contrast, Weibo only contributes to 1.7% of the Traffic despite the deep integration with Taobao.

Douyin is the 2nd largest traffic source for Taobao contributing 6.6% of traffic.

Surprisingly among the top 3 e-commerce platforms, Taobao is the one who is most dependent on WeChat traffic, despite the strategic alignment between Pinduoduo, JD, and WeChat. Part of the reason might be that users are able to complete a purchase using the WeChat Mini Program version of JD and Pinduoduo. For Taobao, users are forced to jump to Taobao in order to make the purchase.

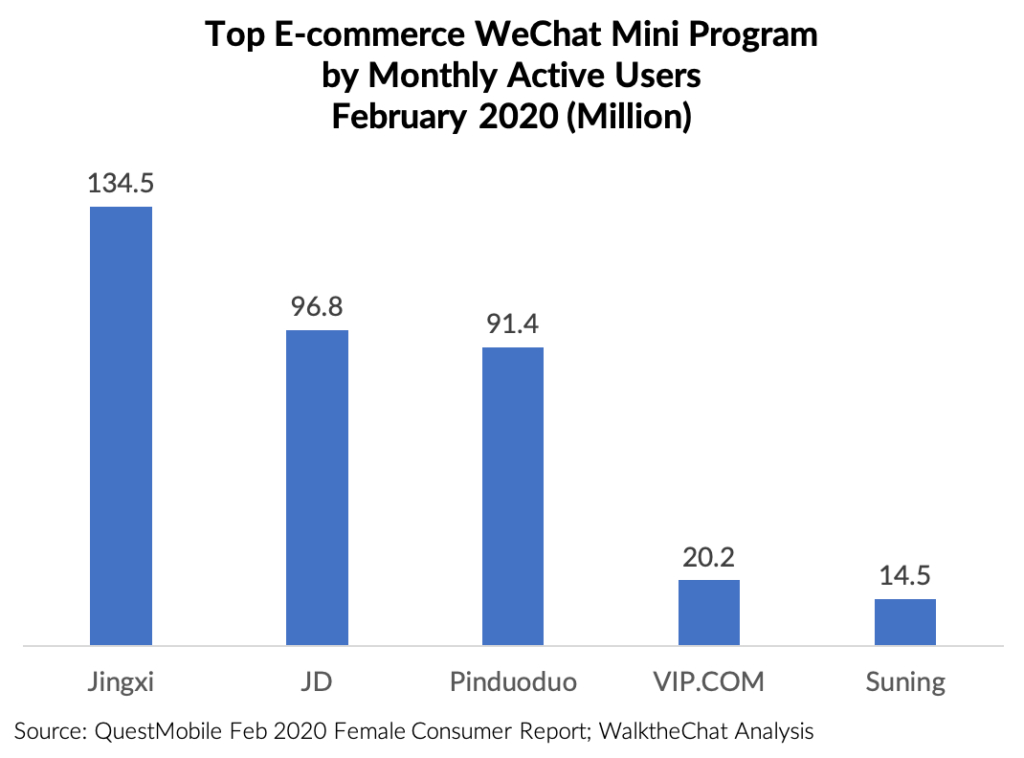

Jingxi, a group-buy WeChat Mini Program launched by JD.com is now the largest WeChat e-commerce Mini Program. Jingxi had a monthly active user base of 134.5 million as of Feb 2020.

Back on October 31st, 2019, WeChat added Jingxi in its Discovery menu. Customers made 60 million orders on that day. Jingxi has become the major source of user growth for JD. After its launch in September, JD’s Q4 2019 customer increased by 27.6 million compared to the previous quarter.

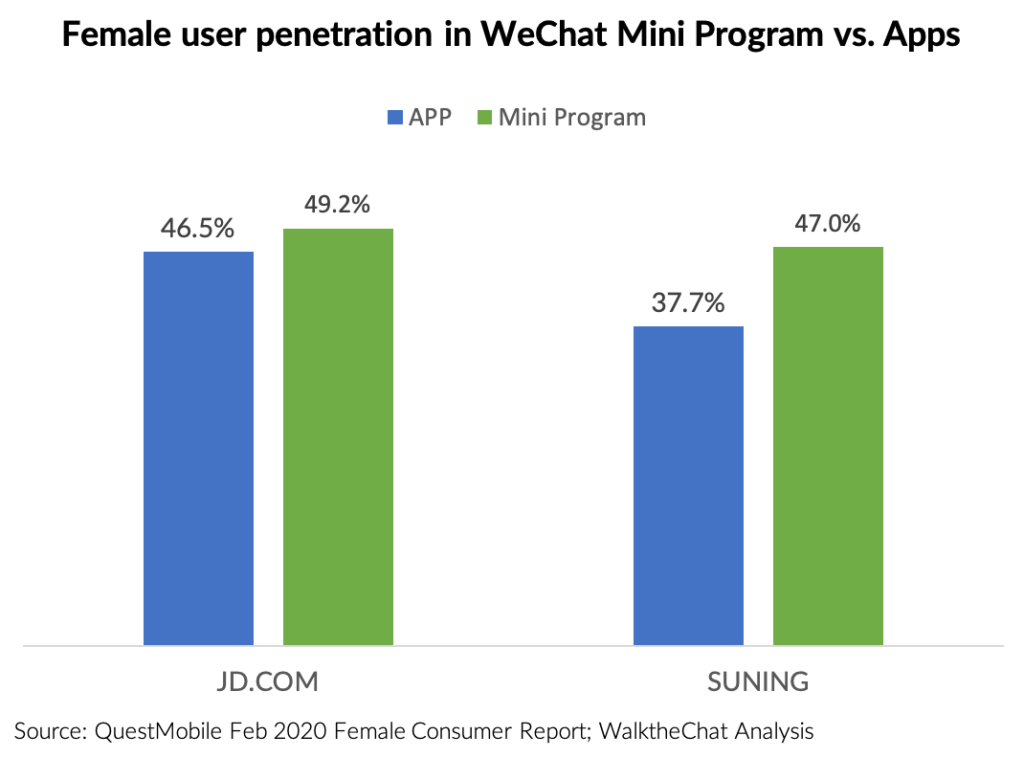

Compared to male users, female users are more active on WeChat Mini Programs than on Apps for both JD and Suning. This could indicate that female customers are more likely to make a purchase based on a Key Opinion Leader recommendation.

Full report here: https://www.questmobile.com.cn/research/report-new/89

Colorkey becomes the No. 1 lip gloss brand on Tmall through social media marketing

Colorkey is a budget cosmetics brand. Its hero product is a 69 RMB “Air” lip gloss. Customers ordered 22 million RMB worth of the Air lip gloss this month, despite a sharp 14.1% drop in the overall cosmetics category due to COVID-19. According to Eburn, this hero product even had a record-breaking 10 million RMB sales day in the middle of the COVID-19 epidemic.

As a brand that targets GenZ population, Colorkey knows how to target its customers on Bilibili, Xiaohongshu, and Douyin.

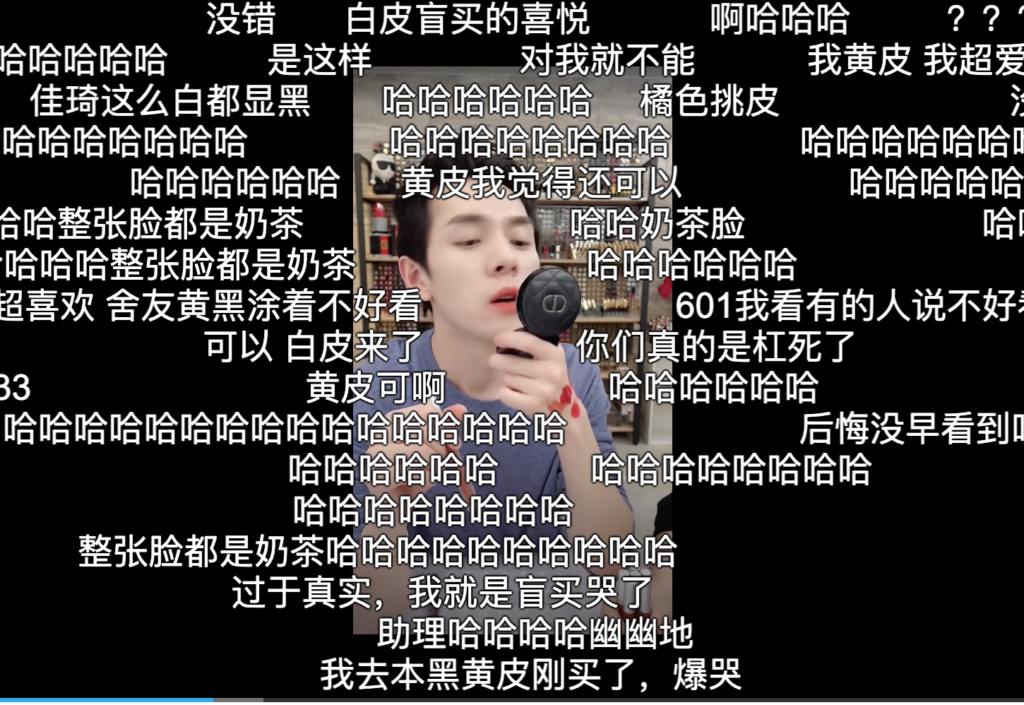

Colorkey has around 700 videos on Bilibili. Most of the videos are posted by cosmetics KOLs, including top tier KOL Li Jiaqi.

Keywords mentioned in Bilibili include: budget, good for students, good for yellow-skin, darker-color lips.

Colorkey works with mid-size Bilibili KOLs to target students. Then it uses the content created by KOLs to launch display ads to target specific followers. According to Lu Hao from Kuaimei, a display ads agency on Bilibili, Colorkey’s display ads ROI reached 251% in February 2020, during the peak of the COVID-19 epidemic.

WeChat testing algorithm-based timeline

Some Android users are beta testing an algorithm-based timeline for WeChat subscription accounts.

The new algorithm will put accounts which have been selected as “Favorite” or with a higher reading rate higher in the timeline. Up to now, the Subscription Account timeline was purely chronological.

WeChat could be the last social media channel that gave up on the chronological news feed.

With the rise of Douyin and Toutiao, users spend less and less time on WeChat. At the same time, many WeChat users already follow 997 WeChat Official Accounts, the maximum number of Official Accounts a user can follow. During commute hours, new articles are pushed every minute. Thus users can easily miss relevant content.

This defensive move might not be enough to regain traffic from Douyin and Kuaishou. But it could slow the trend of users leaving WeChat by improving users’ reading experience.